Today, we are introducing a new brand identity for Parkway to better communicate our role as enablers for financial and banking service providers. For almost two decades we have played the part; it is time for us to also dress the part.

Before the buzz, ahead of the curve

We are not here because of the buzz, we were here before the buzz. It’s been almost two decades but the focus remains the same — digitizing and simplifying how people experience money.. Today we are leading the way ahead of the curve, leveraging our experience to make it simpler and easier for financial and banking service providers to stay ahead and win.

Why has Parkway Rebranded?

To put it simply, we outgrew our old look. It’s like wearing this same outfit for so long, it just doesn’t fit anymore. Our old look did little in representing us as the enablers we were to our partners. So we decided to reinvent our look and step into the light. Our rebrand is not just about us looking good, it’s about the greater work that is before us in the next decades and that is “enabling inclusive and efficient financial services for Africans”.

What hasn’t changed?

Since we embarked on this journey we have consistently fueled this same belief that — money can be simpler and seamless. This is deeply rooted in our DNA. That is why in the next coming decades we will continue to fuel this belief by enabling inclusive and efficient financial services for Africans by enabling African businesses with reliable financial technology infrastructure to help them stay ahead of the curve and win.

What has changed?

- We have a new logo

Build! Faster.

Our new mark is a visual representation of an alternative and faster route to get from points a to b — which is the curved hypotenuse of the resulting ‘triangle’. The mark also brings a corner piece to mind as an essential part of getting a building started or marking territory.

Overall, it’s simple, and edgy.

- Our new colour way

Our new colour palette is a mixture of strong base colours and lively ones to give off a balanced and exciting combination.

- Our new patterns

Amplifying the faster route, visualized by the gently sloping diagonal lines in the logomark, we formed a bold and playful pattern and visual device that can be applied on compositions across mediums.

- Watch it all come together

What is next for Parkway?

There is a growing sentiment that every startup will eventually become a fintech or a social network. If people ever have to pay to use it, you may just build a ramp to help people get a better experience with their money.

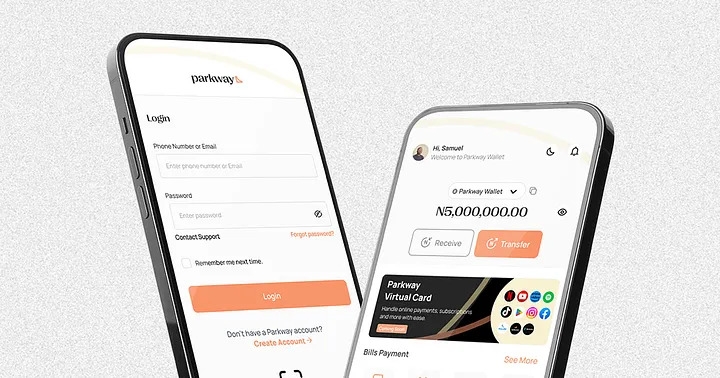

For almost 2 decades we’ve stayed consistent and now we want to scale our impact by leveraging our experience to build easy-to-use products/tools that reduce the time to market for fintechs in Africa. Thereby enabling inclusive and efficient financial services for Africans. Let’s win!!! Together.